Key Findings from the Wealth-X World Ultra Wealth Report 2019

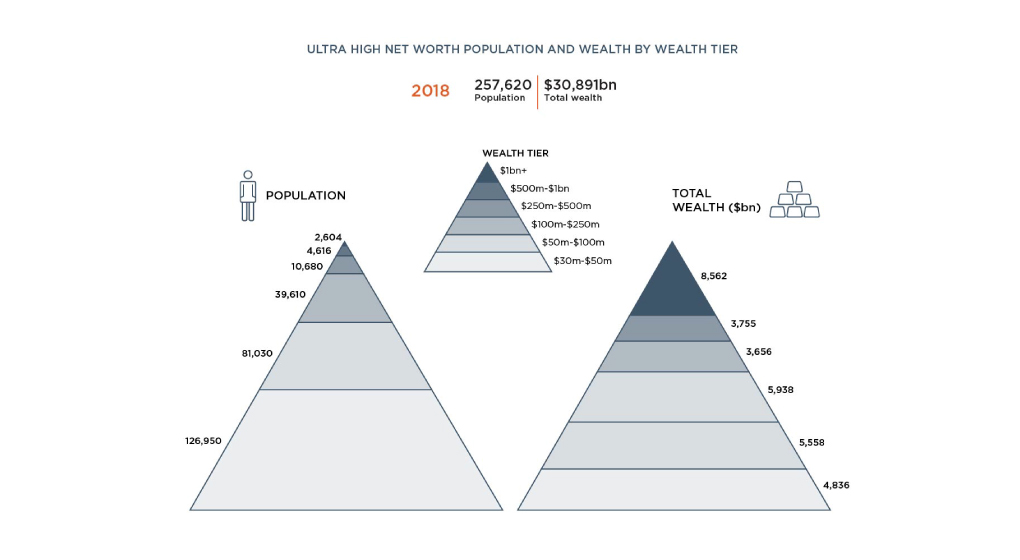

For well over a decade, the world’s wealthy population has experienced exceptional growth. This trend, combined with the increased globalization of goods and services, has created intense competition to capture the interest of individuals in the highest tiers of wealth. Analyzing the landscape of this highly valuable audience provides insight into where, when, and how to engage them most effectively. In late September, Wealth-X released the 7th edition of our annual World Ultra Wealth Report, providing an in-depth analysis of the world’s ultra high net worth (UHNW) population, an exclusive group of wealthy individuals located across the globe, each with $30m or more in net worth.

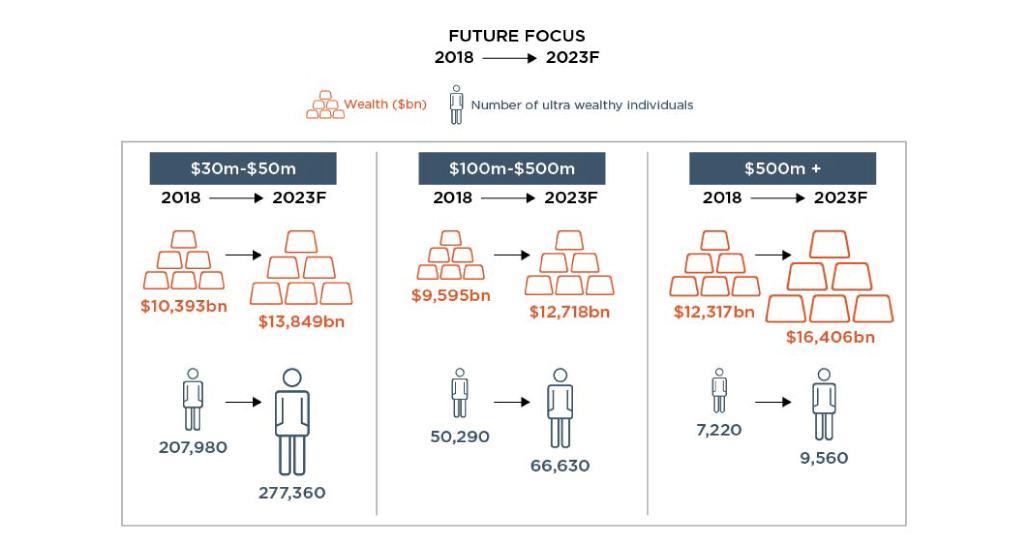

Amid world trade tensions, softening economic growth and reduced monetary stimulus, the report examines the development of the ultra wealthy sector in 2018, exploring the wealth drivers, regional trends and the distribution of wealth, and profiles the ultra wealthy population in terms of asset holdings, sources of wealth, industry focus, gender, interests and hobbies. We delve into our proprietary data assets to rank the leading countries and cities of the world in terms of their ultra wealthy populations. The report also presents our outlook for the ultra wealthy population and its combined net worth to 2023, looking in depth at prospects by wealth tier.

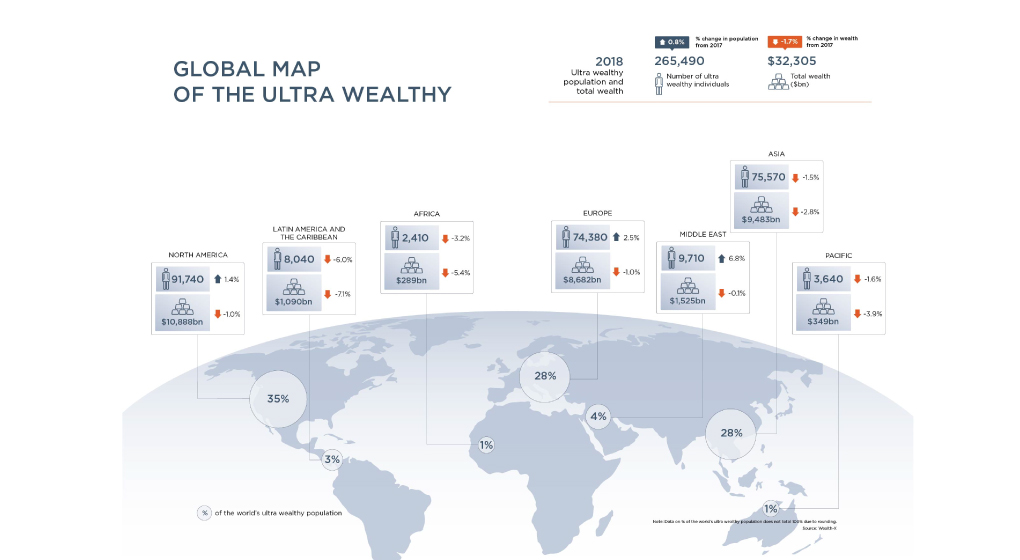

Stagnant Growth

The size of the global ultra high net worth (UHNW) was broadly stable in 2018, edging higher by 0.8% to 265,490 individuals. This marked a sharp slowdown from 2017’s double-digit growth and was a challenging year for investors and asset markets, characterized by rising world trade tensions, softening economic growth and reduced monetary stimulus. This was the first annual fall in three years and implied a modest drop in the average net worth of the UHNW class. Yet it is important to place this performance in context because it followed a period of dynamic wealth creation in 2017, when almost all asset markets recorded impressive gains. Despite the slight turnaround, the combined net worth of the ultra wealthy population in 2018 remained well above its level of two years earlier.

Major Wealth Drives

Asset portfolios in Latin America and the Caribbean have had a roller-coaster ride in recent years. Substantial ultra wealth losses in 2016 were followed by vigorous double-digit average gains in 2017, but the region’s UHNW class endured another di cult year in 2018. Emerging-market turbulence, weak economic growth, volatile commodity markets, policy uncertainty and shifting political tides all took their toll, resulting in a 6% decline in the ultra wealthy population and a 7% drop in combined wealth.

New governments with different policy directions entered o ce in the two largest economies, Brazil and Mexico, while Argentina suffered a mid-year currency slump that led to renewed intervention from the International Monetary Fund. Weakening Asian demand, the fallout from the US-China trade war, and uncertainty linked to NAFTA renegotiations weighed heavily on the region’s commodity exporters, with wealth holdings also under pressure from the depreciation of local currencies against the dollar (the Brazilian real fell by 12%) and declining equity markets. In this strained context, Mexico was a stand-out performer, recording gains in its ultra wealthy population and collective net worth, supported in part by the country’s deep integration with the expanding US economy.

Future Forecast

After hitting the ‘sweet spot’ for global wealth creation in 2017, wealth preservation became the primary focus for many UHNW individuals in 2018. The late-year slump in equity markets meant that investors entered 2019 with some trepidation against a backdrop of slowing global growth and rising tensions in world trade. Developments over the first half of the year largely justified this sense of caution, with volatile asset markets, a deepening US-China trade war, rising Brexit-related threats and weaker global demand bringing about another challenging environment for wealth generation.

by Manuel Bianchi

Managing Director and Head of Global Sales @ Wealth-X